Free Online Sales Tax Calculator – Add or Remove Tax Easily for Shopping and Business in

Shopping online or in-store often leaves you wondering about the final price after tax, and it's frustrating when the total at checkout is higher than expected due to sales tax. I remember buying electronics during a big sale and being surprised by the added sales tax that pushed the total over my budget, turning a great deal into an average one. A reliable free online sales tax calculator helps avoid that surprise by letting you add or remove tax quickly to see the real cost or pre-tax amount. At CalcZone.in, our free online sales tax calculator does just that, with simple inputs for amount and rate, supporting add/remove options for accurate results worldwide in , making it the best free online sales tax calculator for shopping, business, and everyday calculations.

In , with varying sales tax rates across US states, countries, and even cities, having a quick and accurate tool is essential for consumers, small business owners, e-commerce sellers, and accountants alike. Whether you're a shopper checking final prices on Amazon or Walmart, a retailer preparing invoices, or someone comparing costs across locations, our free online sales tax calculator add remove tax easily provides instant clarity. It's not about complicated spreadsheets or manual math – it's about smart, fast decisions so you shop wisely, price products correctly, or manage budgets without overpaying or undercharging due to tax miscalculations.

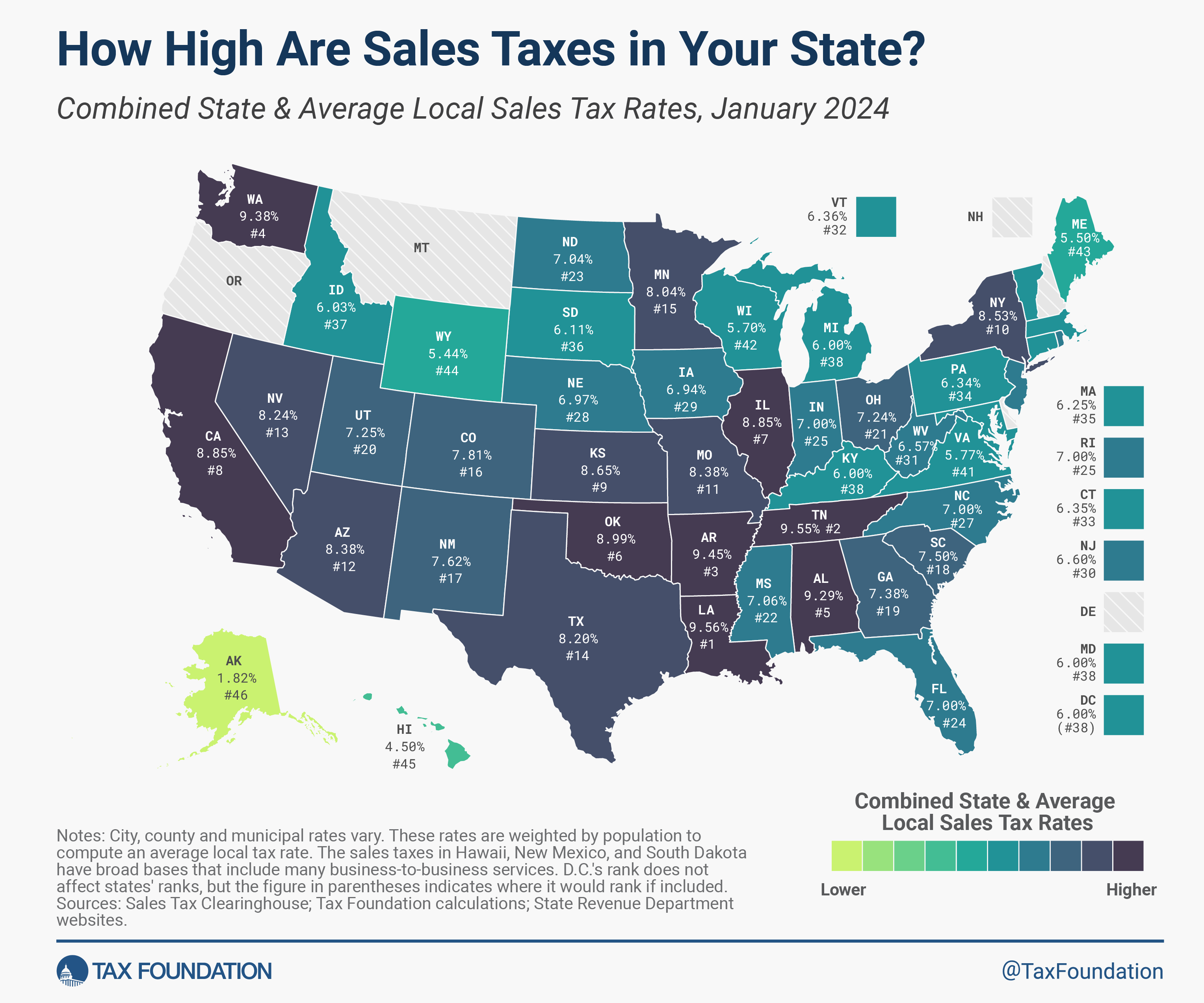

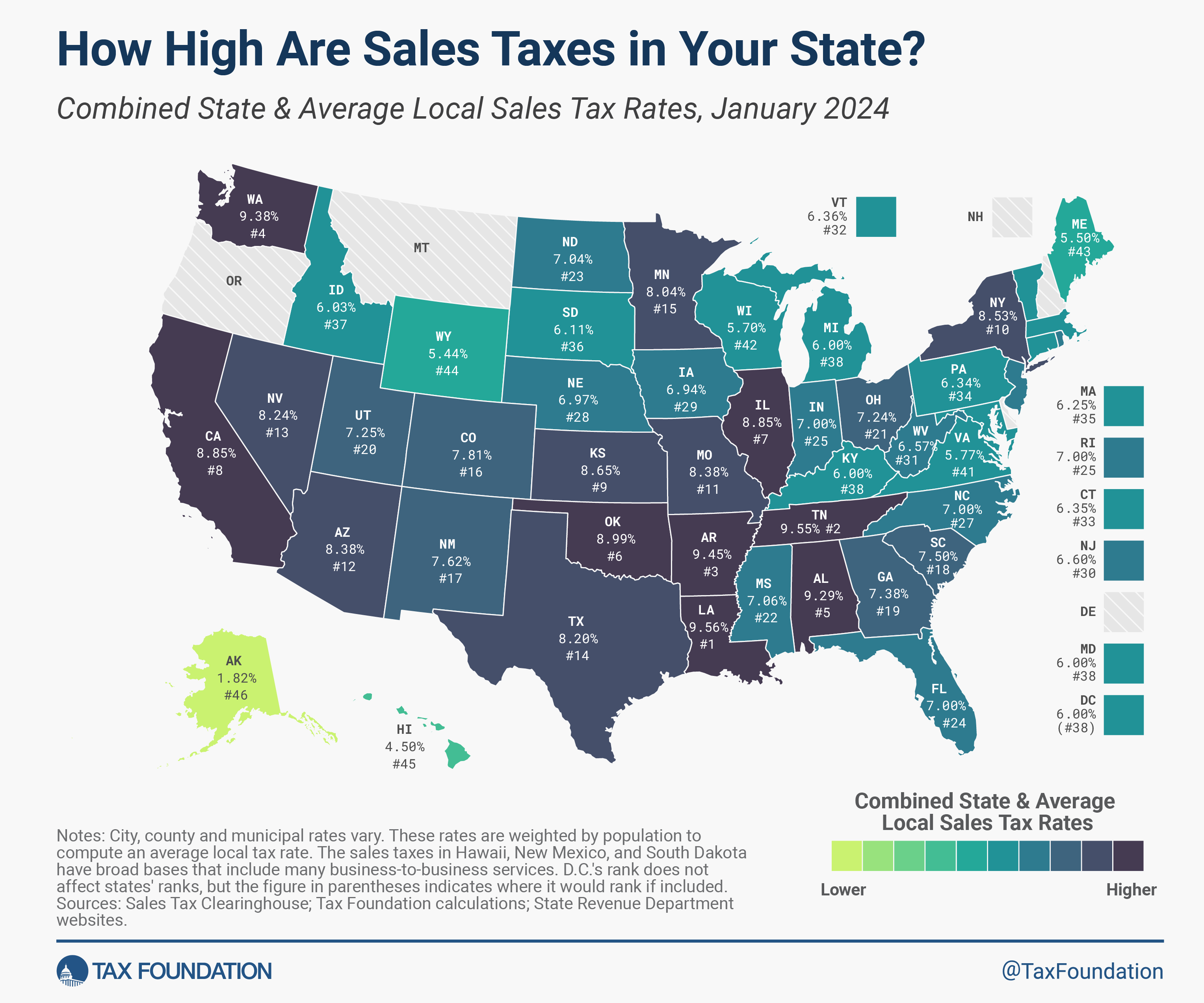

Let's explore why this free online sales tax calculator for add remove tax in is essential in today's shopping and business landscape. Sales tax is a consumption tax imposed by governments on the sale of goods and services, typically a percentage of the purchase price added at checkout. In the US, it's state and local, ranging from 0% in Delaware, Oregon, New Hampshire, Montana, Alaska to over 9% combined in states like California, Tennessee, Louisiana with city add-ons. Globally, it's called VAT or GST in many countries – 20% in UK, 10% in Australia, 13% HST in Canada provinces. Many people search for "free online sales tax calculator US states " or "best free sales tax calculator add remove tax online free" because they want to estimate totals before buying or reverse calculate from receipts. Our free online sales tax calculator for US state rates and worldwide VAT GST in handles both with precision.

For online shopping, platforms like Amazon now collect sales tax in most states due to Wayfair ruling, making estimation key for budget. This free online sales tax calculator for online shopping Amazon eBay Walmart helps see true cost. For international purchases, add customs duty approximation with custom rate. This free online international sales tax VAT calculator online free is versatile.

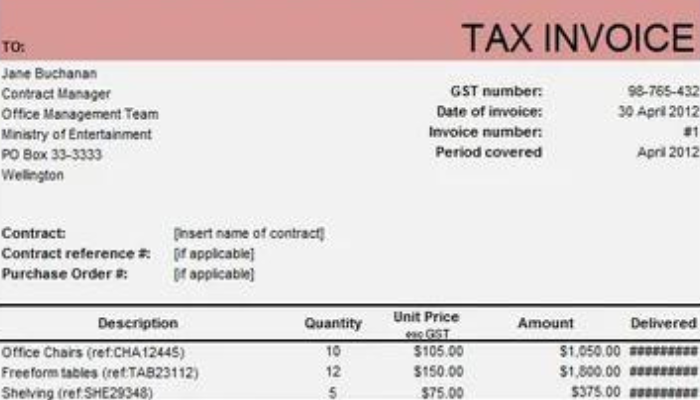

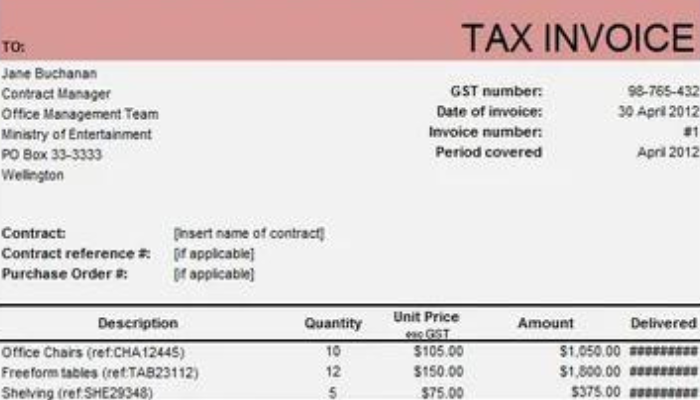

Business owners use for pricing – add tax to wholesale for retail. This free online sales tax calculator for business invoice billing online free ensures accurate quotes. For reverse from inclusive total, find pre-tax for expense tracking. This free online reverse sales tax calculator remove tax from total online free essential for accounting.

Simple sales tax calculator interface – enter amount, rate, choose add/remove for instant tax and total in .

How Does a Sales Tax Calculator Work? Simple Explanation for Add and Remove Tax Calculations

The magic behind any good free online sales tax calculator add remove tax is basic math but instant. For adding tax: Tax Amount = Amount × (Rate / 100), Final Total = Amount + Tax Amount. Simple multiplication and addition. For example, $100 item at 8% sales tax adds $8 tax for $108 total. This free online sales tax add calculator online free is perfect for pre-checkout estimation.

For removing tax from inclusive total: Tax Amount = Total - (Total / (1 + Rate/100)), Pre-Tax Amount = Total - Tax Amount. Reverse engineering to find original price. If total $108 at 8%, pre-tax $100. This free online sales tax remove calculator from total online free is useful for receipts, refunds, or expense reports.

Our free online sales tax calculator for add remove tax worldwide handles both modes seamlessly, with decimal precision for accurate cents. For those searching "how to calculate sales tax from total amount online free" or "how to add sales tax to price online free", our tool explains results clearly.

Step-by-Step Guide to Using Our Free Online Sales Tax Calculator

Using the best free online sales tax calculator add remove tax in is straightforward. First, enter the base amount or total amount in dollars or local currency. Then, input the applicable sales tax rate as percentage (e.g., 8.25 for Texas). Select calculation type – add sales tax for final price or remove sales tax for pre-tax amount. Click calculate for instant tax amount and final/pre-tax result.

For example, $500 purchase at 7% add sales tax – tax $35, total $535. Remove from $535 at 7% – base $500. This simple free online sales tax add remove calculator online free is beginner-friendly with no signup.

For multiple items, calculate each or total – flexible. This free online bulk sales tax calculator approximation online free helps shopping lists.

Sales Tax Rates Around the World and in US States – Complete Guide

In the US, sales tax varies by state and local jurisdiction, with combined rates from 0% in no-tax states (Delaware, Oregon, New Hampshire, Montana, Alaska) to highest in Tennessee (9.55%), Louisiana (9.55%), California cities up to 10.75%. Average around 7%. Many search "free online US state sales tax calculator " or "free online California New York Texas Florida sales tax calculator online free" for location-specific. Our tool with custom rate covers all states and cities.

Globally, VAT/GST rates: UK 20%, Germany 19%, France 20%, Canada GST 5% + provincial HST/PST up to 15%, Australia 10%, India GST 0-28% slabs, Japan 10%. This free online worldwide VAT GST sales tax calculator online free handles international.

In , with digital economy tax rules, more countries collect on online sales. This free online digital sales tax calculator for e-commerce online free essential for cross-border.

US sales tax rates by state in – from no tax to high combined rates using free online sales tax calculator.

Common Sales Tax Rates and Examples for Popular States and Cities

California average 8.82%, Los Angeles 9.5%. New York state 4% + local up to 8.875% NYC. Texas 6.25% state + local up to 8.25%. Florida 6% + county up to 8%. Illinois Chicago 10.25%. This free online state city specific sales tax calculator online free accurate with custom input.

For food/clothing exemptions in some states – approximate taxable only.

Benefits of Using a Free Online Sales Tax Calculator for Shopping and Business in

The biggest advantage of the best free online sales tax calculator add remove tax is avoiding checkout surprises and budgeting accurately for purchases. Online shoppers estimate Amazon eBay Walmart totals with tax. This free online sales tax calculator for online shopping Amazon eBay Walmart prevents overspending.

For business, price products correctly with tax inclusive/exclusive. This free online sales tax calculator for business invoice billing pricing online free ensures professional quotes.

Reverse for expense tracking from receipts showing total. This free online reverse sales tax calculator remove tax from total online free useful for reimbursements.

In , with marketplace facilitator laws, sellers comply easier with estimation. This free online e-commerce sales tax calculator for marketplace online free vital.

Sales Tax for Online Purchases and Cross-Border Shopping

Most US states collect sales tax on online purchases from out-of-state sellers post-Wayfair. Estimate with destination rate. This free online out of state online purchase sales tax calculator online free plans budget.

For international, add VAT/GST and duty approximation. This free online international shopping sales tax VAT calculator online free helps global buyers.

Sales Tax Calculator for Invoices, Billing, and Accounting in

Add tax to quotes for clients. Our tool generates breakdowns for professional invoices. This free online sales tax invoice calculator for business billing online free streamlines.

For freelancers, calculate taxable services. This free online freelance sales tax calculator online free accurate.

Example sales tax invoice – subtotal, tax, total for clear billing using free online sales tax calculator.

Avoiding Common Sales Tax Mistakes and Compliance Issues

Wrong rate for location – always check current. Inclusive vs exclusive pricing confusion – use correct mode. For nexus states, collect properly. Our tool for estimates – consult pro for filing.

Exempt items like groceries in some states – calculate taxable separately.

The Future of Sales Tax in – Digital and Global Trends

More states and countries collect on digital goods, services, remote sales. AI automation for compliance. Our tool stays current for estimates. This free online digital services sales tax calculator online free future-proof.

With crypto NFT sales tax emerging, approximate with tool.

Real-Life Stories from Users of Sales Tax Calculator

A shopper estimated Amazon cart tax, stayed under budget. A small business owner priced correctly, avoided losses. An accountant verified client receipts quickly with reverse. These show practical impact of free online sales tax calculator add remove tax .

An online seller compared state nexus, optimized inventory.

FAQs on Sales Tax Calculators

What is the best free online sales tax calculator ?

Our tool at CalcZone.in with add/remove for US states worldwide.

How to calculate sales tax on purchases online free ?

Enter amount, rate, add for total with tax.

Can I remove sales tax from total online free?

Yes, reverse mode for pre-tax base amount.

What's average US sales tax rate by state ?

0-10%, input local for accuracy.

Is there free sales tax calculator for online shopping Amazon?

Yes, estimate before checkout.

How does add vs remove sales tax work?

Add for final price, remove for original pre-tax.

Free online California sales tax calculator ?

Use 8.82% average or city specific.

Best free VAT GST calculator worldwide online free?

Custom rate for any country.

Free sales tax calculator for e-commerce business?

Yes, for pricing and compliance estimates.

How to calculate reverse sales tax from receipt total?

Remove mode with known rate.

Sales tax adds up over time – calculate accurately to control costs and make informed purchases or sales decisions in .